Maybe it’s because the nuns at school successfully gave me Catholic guilt about overspending.

Or it’s because I know what it’s like being poor (and not poor).

Regardless, I’ve saved like a mad man since I was 19.

Because of that, I’ve learned what works and doesn’t work (for me). So, today I will explain my process.

But first, a few points:

- Saving money is equal parts earning more income and spending less. I’ll talk about earning more another time.

- Saving is not being cheap. It’s about having money to spend on things that truly make you happy instead of over consuming on stuff that leaves you empty.

- Finally, I view this as much a spiritual thing as finance thing. It feels good knowing what makes me happy and what doesn’t. It feels good knowing I need very little to be happy but I can splurge if I want. And most of all, coming from a position of ‘fuck you’ is the best feeling in the world.

So, this blog is for anyone who has less than 36 months in savings.

And by savings, I mean assets that you can easily liquidate. Savings, stock, 401k…things like that.

Now, you may think 36 months is crazy. Most people would agree. Most ‘experts‘ say 6 months is a good goal. I think that’s way too short.

I’m also very conservative with money as I’m an entrepreneur. When business is booming, I’m rolling in it. But when business sucks or I’m starting something new, my income is the first thing that stops.

Hence, 36 months, a number I feel comfortable at.

So, here are the steps to take:

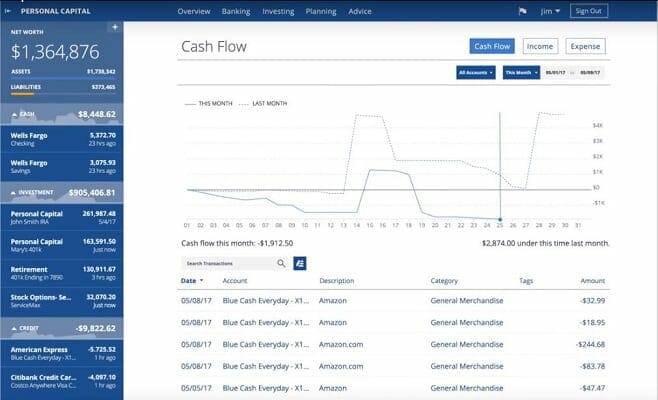

1. Sign up for Personal Capital

It’s a free service that aggregates all your accounts. It’s like Mint, but I think it’s easier to use. Just do it now. It takes 10 minutes. Check this monthly to see your income and expenses. This is my favorite tool.

2. Download My Weekly Budget

It’s .99 and will force you to track your spending manually. Each time you spend, write it down. It doesn’t matter if you have a budget or not (which you should), tracking something forces you to notice it and typically leads to improvement.

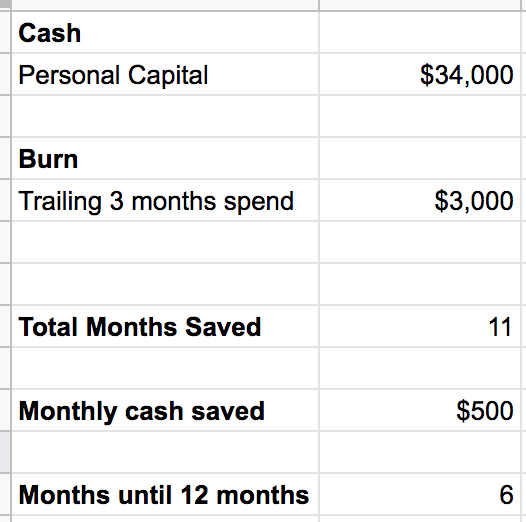

3. Create a personal burn and runway spreadsheet

Look at your trailing 3 months of spending on Personal Capital. Average it. That’s your burn. In your spreadsheet, divide that by your liquid assets. That’s your runway. This doesn’t need to be fancy.

4. Create your goals

3 months, 6 months, 12 months, 24 months, 36 months. Make those your benchmarks. If you have less than 3 months in cash, your goal is to get there first. Then 6, then 12 and so on. Put this in your spreadsheet.

5. Set your budget

Now, this is up to you. Look at your current expenses in Personal Capital. Decide what makes you happy and what doesn’t. Cut what doesn’t. See your monthly burn without those things. Make that your monthly budget. Use My Weekly Budget to create yourself a weekly budget. If you spend, write it in My Weekly Budget. Stick to your budget.

For reference, I once read the average American saves

6. Pay off high interest debt first…factor that in your budget

Debt is its own topic. But I think there are two ways to go about this: pay off high interest debt first or pay off your small loans first so you create momentum. If you don’t have debt then DO NOT GO INTO DEBT again until you’ve hit your savings goal. Debt can be crushing.

7. Stick to the plan and feel the pain

If you’re not hurting then you’re not saving enough. Just do it. If you’re young, in debt, or are starting from $0 then this process will take years, maybe decades. Embrace it. It’s worth it. It hurts so good. But know this: coming from a position of fuck you because a) you don’t need much to be happy and b) you have the money to do what you want, is worth the pain.

Of course, if you’re happy with your current situation then ignore everything I just said. You’re winning.

Here are a few tools to make your journey better:

- Robinhood: I buy stock, I rarely sell it. Robinhood makes that easy. I pretty much only buy Facebook and a general S&P500 fund.

- Ally Bank: It’s a saving’s account with 2% interest. At $10,000 that’s $200 a year. At $100,000, it’s $2000. It can add up fast. Other banks offer this, but I like Ally.

- RoboAdvisors: I like Wealthfront. Bettermint and a few others can get the job done too. I keep a fair bit of money in Wealthfront and set the risk tolerance as high as it goes.

OK folks. That’s my process.

Let me know in the comments what you think and I will reply.

Thanks for sharing! 50% sure *feels* like a lot. I bet the earlier you start, the better. Also, I’ve never heard anyone say to save up for 36 months worth of expenses but, oddly, I do know someone who has done this. I’m going to let this one simmer for a bit.

To me, everyone who overspends is just dumb. Makes ZERO sense to carry a balance on your credit card or spend money you don’t have. Simply make money and don’t spend it all.

Tracking expenses and net worth are simple, I’ve been doing it for years.

The hardest part for me is too actually make money (at least decent income consistently without stressing out all the time) — because I have good skills but also huge liabilities/problems.